HP सरकार पे मैट्रिक्स टेबल और महंगाई भत्ता (DA) दर चार्ट 2026 तक

HP Govt Pay Matrix Table 2026; The Himachal Pradesh (HP) Government follows a well-structured Pay Matrix System based on the recommendations of the 7th Central Pay Commission. This system ensures transparency and uniformity in salary calculations for all state government employees. Along with the Pay Matrix, the Dearness Allowance (DA) is revised every six months to offset inflation and provide financial protection to employees and pensioners.

This detailed report explains the HP Govt Pay Matrix Table, Pay Levels for different posts, and the complete DA Rate Chart up to 2026 for Himachal Pradesh Government employees and pensioners.

What is the HP Government Pay Matrix Table?

The Pay Matrix Table is a simplified salary structure where each post is assigned a specific Pay Level. Every Pay Level contains progressive salary cells that correspond to annual increments. The HP Government has adopted this system to make pay fixation, promotion, and salary progression more systematic and transparent.

The key components of the HP Pay Matrix include:

- Pay Level (PL)

- Basic Pay

- Annual Increment

- Promotion Pay Fixation

- Pension and Retirement Benefits

HP Govt Pay Matrix Table – Overview

The following table gives a simplified overview of the pay levels commonly used in the Himachal Pradesh Government service:

| Pay Level | Basic Pay Range (₹) | Typical Posts |

|---|---|---|

| PL-1 | 10,300 – 34,800 | Class-IV Staff, OM, Peon |

| PL-2 | 16,100 – 53,800 | Clerks, Junior Assistants |

| PL-3 | 21,700 – 69,100 | Typists, Senior Clerks |

| PL-4 | 28,900 – 92,300 | Assistants, Supervisory Staff |

| PL-5 | 34,800 – 1,12,400 | Section Officers, Head Clerks |

| PL-6 | 43,000 – 1,28,900 | Teachers, Senior Officers |

| PL-7 | 47,600 – 1,51,100 | Inspectors, Senior Technical Staff |

| PL-8 | 53,100 – 1,67,800 | Assistant Directors, Deputy Officers |

| PL-9 | 56,100 – 1,77,500 | Administrative Officers |

| PL-10 to PL-20+ | 67,700 – 2,18,200+ | Class-I Officers, Directors, Senior Administrative Roles |

Dearness Allowance (DA) for HP Government Employees

The Dearness Allowance (DA) is provided to compensate for the rising cost of living. The HP Government follows the Central Government’s DA revision cycle:

- 1st January (Winter session revision)

- 1st July (Monsoon session revision)

DA is applicable to:

- Regular employees

- Pensioners (as Dearness Relief – DR)

- Family pensioners

HP Govt DA Rate Chart – 2022 to 2026

The table below includes actual DA revisions till now and projected DA rates up to 2026 based on CPI-IW inflation trends:

| DA Period | DA % | Remarks |

|---|---|---|

| Jan 2022 | 31% | Central DA adopted |

| Jul 2022 | 34% | 3% increase |

| Jan 2023 | 38% | 4% increase |

| Jul 2023 | 42% | 4% increase |

| Jan 2024 | 46% | 4% increase |

| Jul 2024 | 50% | DA touched 50% limit |

| Jan 2025 | 54% (Projected) | Expected due to rising inflation |

DA for HP Government Pensioners

Pensioners receive Dearness Relief (DR), which is equal to the DA rate given to state government employees.

Example Calculation:

Pension × DA%

Sample: Pension = ₹25,000 DA = 50% DA Amount = ₹12,500 Total Pension = ₹37,500

Key Highlights for HP Govt Employees & Pensioners

- HP follows Central DA pattern with biannual revisions.

- Pay Matrix ensures systematic salary progression.

- Pensioners benefit through equal Dearness Relief (DR).

- Projected DA rates help plan future financial benefits.

- DA crossing 50% may revise certain allowances (subject to state notification).

The HP Government Pay Matrix Table provides a transparent pay structure for employees across all categories. With DA revisions expected to rise steadily up to 2026, both employees and pensioners can anticipate increased financial support. Keeping track of DA notifications and pay matrix revisions is essential for accurate salary planning.

Check all 1 to 31 Pay Level Salary Strucute

| Pay Level 1 to 31 | Check Here |

| Pay Level 1 | Click Here |

| Pay Level 2 | Click Here |

| Pay Level 3 | Click Here |

| Pay Level 4 | Click Here |

| Pay Level 5 | Click Here |

| Pay Level 6 | Click Here |

| Pay Level 7 | Click Here |

| Pay Level 8 | Click Here |

| Pay Level 9 | Click Here |

| Pay Level 10 | Click Here |

| Pay Level 11 | Click Here |

| Pay Level 12 | Click Here |

| Pay Level 13 | Click Here |

| Pay Level 14 | Click Here |

| Pay Level 15 | Click Here |

| Pay Level 16 | Click Here |

| Pay Level 17 | Click Here |

| Pay Level 18 | Click Here |

| Pay Level 19 | Click Here |

| Pay Level 20 | Click Here |

| Pay Level 21 | Click Here |

| Pay Level 22 | Click Here |

| Pay Level 23 | Click Here |

| Pay Level 24 | Click Here |

| Pay Level 25 | Click Here |

| Pay Level 26 | Click Here |

| Pay Level 27 | Click Here |

| Pay Level 28 | Click Here |

| Pay Level 29 | Click Here |

| Pay Level 30 | Click Here |

| Pay Level 31 | Click Here |

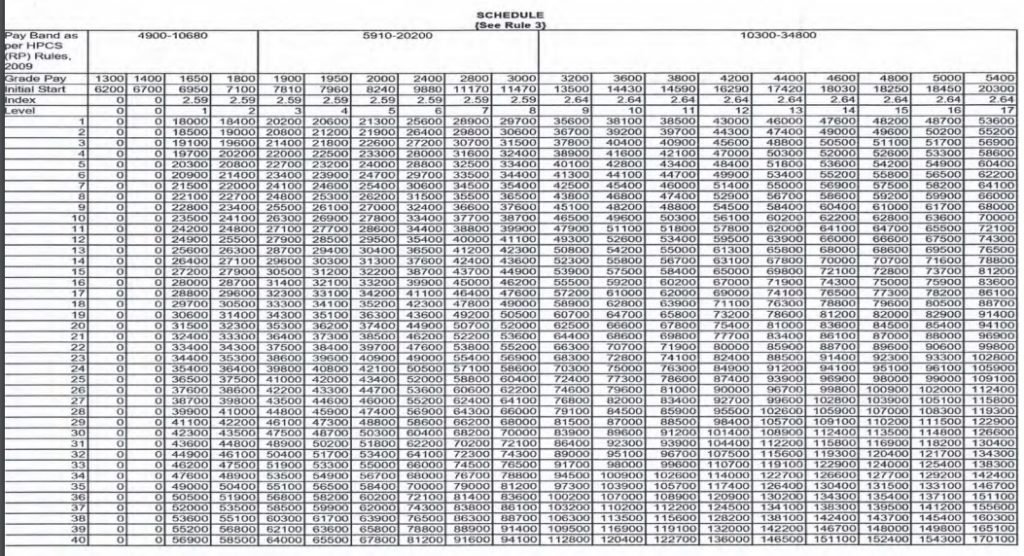

HP Pay Matrix Table for Pay Level 1 to 17

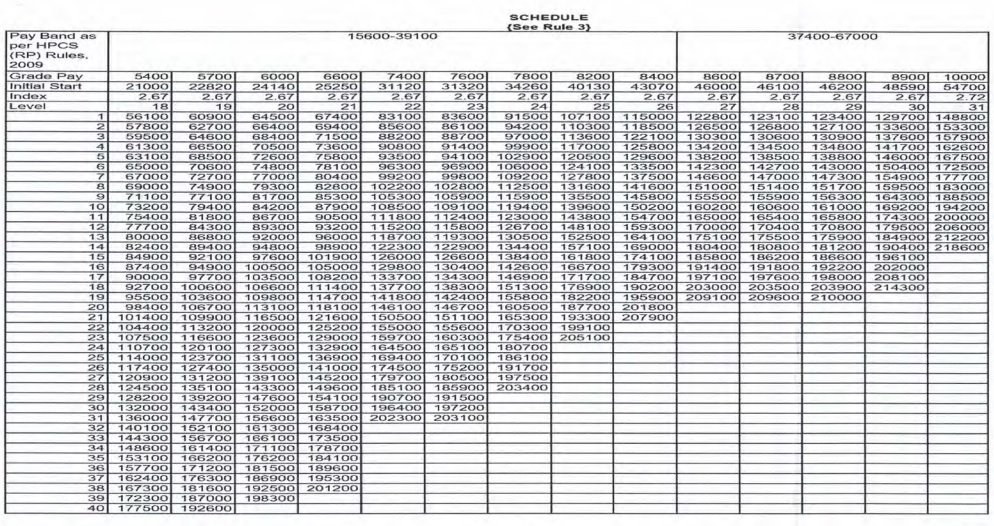

HP Pay Matrix Table for Pay Level 18 to 31

What is the HP Government Pay Matrix Table?

The HP Government Pay Matrix Table is a structured salary chart introduced after the 7th Pay Commission. It organizes salaries into Pay Levels, making pay fixation, increments, and promotions transparent and uniform across Himachal Pradesh Government departments.

How many Pay Levels exist under the HP pay structure?

Himachal Pradesh follows Pay Levels 1 to 20+, covering all categories of government employees—from Class-IV staff to Class-I officers and senior administrative positions.

How often is DA revised for HP Government employees?

Dearness Allowance (DA) is revised twice every year, following the Central Government schedule:

1st January

1st July

These revisions help compensate employees and pensioners for inflation.

Do HP Government pensioners receive DA?

Yes. Pensioners in Himachal Pradesh receive Dearness Relief (DR), which is always equal to the DA percentage given to serving state government employees. DR is applied to basic pension and family pension.

HP Govt Pay Matrix Examples (With Detailed Calculations)

The following examples are taken from the Himachal Pradesh Civil Services (Revised Pay) Rules, 2022 and illustrate how pay is fixed for various categories of government employees. These examples simplify the rules for easy understanding.

Example 1: Pay Fixation Without Re-Revision 2012 (Factor 2.59)

This illustration applies to employees whose pay band and grade pay were not re-revised under the 2012 rules.

| Step | Description | Result |

|---|---|---|

| 1 | Existing Pay Band | PB-5 (₹37,400 – ₹67,000) |

| 2 | Existing Grade Pay | ₹8,700 |

| 3 | Level as per 2022 Rules | Level-28 |

| 4 | Existing Basic Pay (31.12.2015) | ₹55,040 |

| 5 | Multiply by factor 2.59 | ₹1,42,553.60 (rounded: ₹1,42,554) |

| 6 | Nearest Pay Matrix Cell | Level-28 → next cell |

| 7 | Revised Pay in Matrix | ₹1,42,700 |

Example 2: Pay Fixation With Re-Revision 2012 (Method-1: Factor 2.25)

For employees who were granted higher PB/GP under Re-Revision 2012, the following method applies:

- Multiply existing basic pay (as on 31.12.2015) by 2.25

- Round off to nearest rupee

- Fit into the nearest or next higher cell in the applicable Pay Level

- Revised pay becomes effective from 01.01.2016

Example 3: Pay Fixation Ignoring Re-Revision 2012 (Method-2: Factor 2.59)

This beneficial method recalculates pay by ignoring the impact of Re-Revision 2012:

- Fix notional pay under 2009 Rules (without 2012 benefit)

- Multiply the notional basic pay by 2.59

- Fit into the nearest or next higher Pay Matrix cell

- Employee may choose whichever method (2.25 or 2.59) gives higher pay

Example 4: Pay Fixation for Employees Who Joined After 01.01.2016

For employees recruited between 01.01.2016 and 03.01.2022:

- Take the Basic Pay on the date of joining

- Multiply by 2.59

- Fit into the appropriate Pay Matrix cell

- Revised pay cannot be less than the first cell of the applicable level

Example 5: Promotion Pay Fixation (Option-1: From Date of Promotion)

When the employee opts for pay fixation from the date of promotion:

- Add one increment in the current Pay Level

- Move to the next higher Level and fit into the nearest higher cell

- Next increment allowed after 12 months

Example 6: Promotion Pay Fixation (Option-2: From Next Increment Date)

This option is often more beneficial. Steps include:

- From promotion date → place employee at immediate next higher cell

- On increment date → apply two increments (annual + promotional)

- Fit into the nearest cell in the higher Level

- Next increment after 12 months from re-fixation date

Example 7: Annual Increment (3%)

All Himachal Pradesh Government employees receive an annual increment of 3%. This is represented by movement to the next vertical cell in the Pay Matrix.

Employees at the last cell of their Level are not eligible for further increments.

Example 8: Stepping-Up of Pay (Senior vs. Junior)

If a junior employee receives higher pay than a senior after revision, stepping-up is allowed when:

- Both employees belong to the same cadre

- Both hold identical posts

- Pay anomaly is caused by the application of 2022 Pay Rules

This ensures that the senior employee gets the same pay cell as the junior.